OSFI’s new mortgage rules will decrease home affordability. OFSI’s (Canada’s banking regulator) has published final guidelines for its mortgage qualification rule. It will impose tighter standards on the uninsured market. Lenders will be required to “stress test” all uninsured mortgage loans at the greater of the Bank of Canada’s five-year (5) posted rate or 200 basis points (2 percentage points) higher than the negotiated contract rate. The rule is applicable where the buyer makes a down payment of at least 20 per cent of the home’s purchase price or higher.

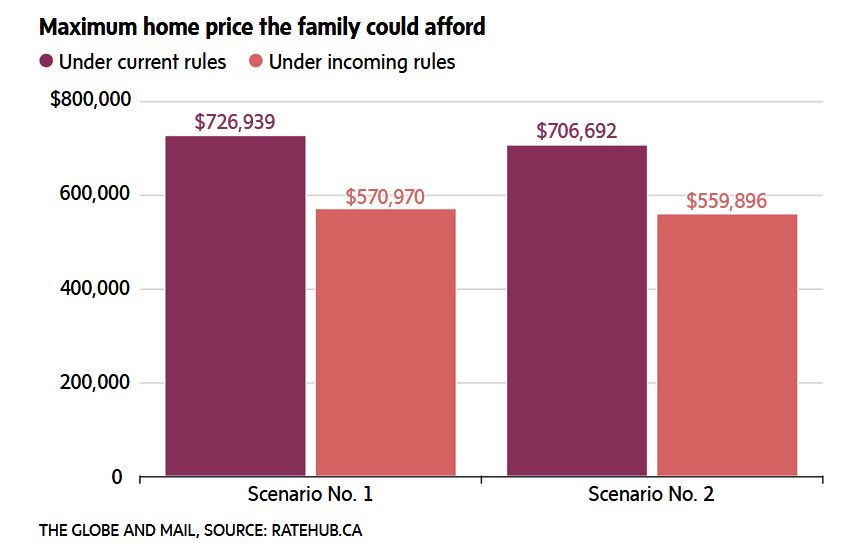

Home affordability will undoubtedly affect as a result of the changes. RateHub.ca (the rate-comparison website) has calculated the maximum price a buyer could afford, under two scenarios, and compared current rules with incoming ones.

The buyer is a family with an assumed annual income of $100,000, accumulated cash savings for a 20-per-cent down payment, and a five-year fixed mortgage amortized over 25 years.

For Scenario No. 1, the family’s mortgage rate is 2.83 per cent. Under incoming rules, the mortgage application faces a stress test using the Bank of Canada’s current five-year benchmark rate of 4.89 per cent. The central bank’s posted rate is higher than the family’s negotiated rate plus 200 basis points (4.83 per cent).

For Scenario No. 2, the family’s mortgage rate is 3.09 per cent. Under incoming rules, the family would be stress tested at 5.09 per cent. That’s because the negotiated rate plus 200 basis points (5.09 per cent) is higher than the BoC’s posted rate (4.89 per cent).

Either way you look at it, the family’s purchasing power will be less when the new rules come into effect on Jan. 1, 2018.

Note: As part of its calculations, RateHub has assumed that monthly property taxes is $400 and monthly heating costs is $150. Calculations are based on a gross debt service (GDS) ratio limit of 39 per cent, which is the maximum allowed by the federal government. The GDS ratio is the percentage of pretax monthly household income required at lerast to pay monthly housing costs, which include principal, interest, taxes, heating and half of condo fees. These examples has not included monthly condo fees into account, which would further reduce affordability. Nor do they assume any other debt obligations a home buyer may have.

If you are planning to sell your home or Condo Apartment in downtown Toronto or in Central Toronto areas, please call, text of email Max Seal, Broker at 647-294-1177. Please visit http://www.TorontoHomesMax.com for a FREE Home Evaluation“.

If you are planning to buy a home or a Condo Apartment in the Central Toronto areas, please call, text of email Max Seal, Broker at 647-294-1177. Please visit my website http://www.centraltorontorealestate.com/ to find out available homes and Condos for sale in Downtown Toronto and Central Toronto areas.

Source: Globe And Mail

Thinking to sell your house or Condo in Central Toronto areas and/or in downtown Toronto areas? Please call, text or email Max Seal, Broker at 647-294-1177. Please visit http://www.TorontoHomesMax.com for a FREE Home Evaluation“.

Thinking to buy a House or Condo in Central Toronto areas and/or in Downtown Toronto areas? please call or text Max Seal, Broker at 647-294-1177 to buy your dream home or Condo. I offer you a 30-min “FREE buyer’s consultation” with NO obligation.

Please visit my website http://www.centraltorontorealestate.com/ to find out available homes and Condos for sale in Central Toronto areas and/or in downtown Toronto areas.

This Toronto housing market may be a better time for “Move-up”, “Move-down” or “Empty-nester” Sellers and Buyers. Want a “Market Update” of your home in 2018? Please click the image below or call or text Max Seal, Broker at 647-294-1177 or send an email.