Looking at the Toronto housing market through an analytical lens of percentages, changing sales numbers and interest rates may be the go-to method for industry insiders, but for many average customers, there’s really one thing that are important:

“What can I afford?”

To help answer that question, let’s calculate what degree of salary you or your household are going to need to attain in order to purchase a home, based on average prices in 2017 so far.

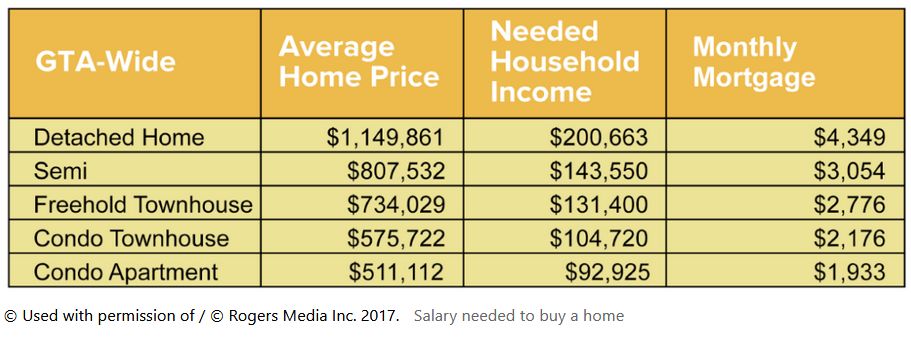

First, we looked at costs for the entire Greater Toronto Area (both the 416 and suburban 905) by property type.

There’s no debating the numbers are overwhelming. But it’s important to note, the salaries represent entire household incomes and not just that of a single person.

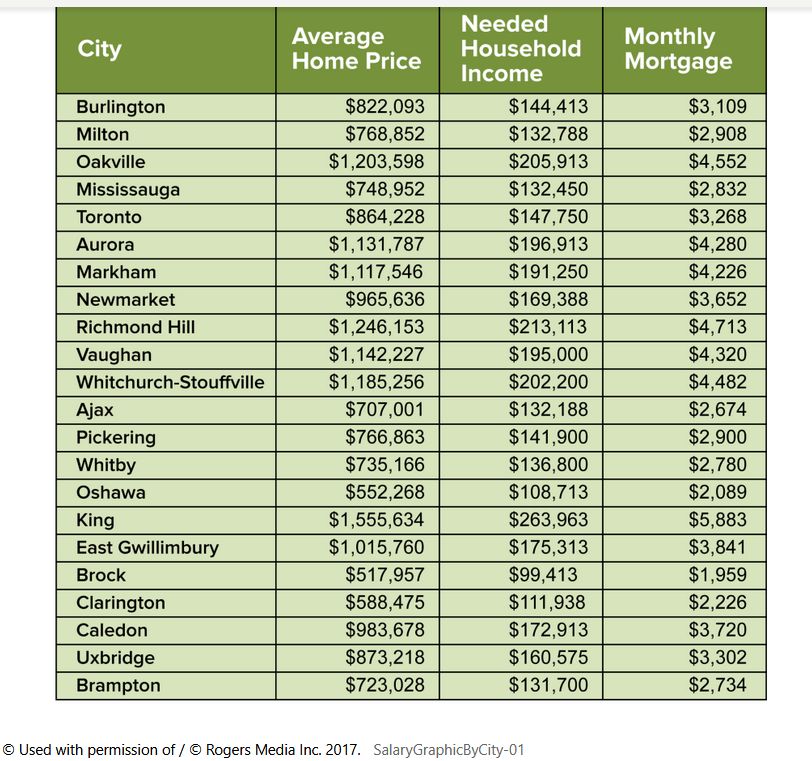

Along with furnishing a broad overview of the region’s marketplace, we also delved up numbers on a per-city basis, give further consideration to prices for all property characters (pooling together detached houses, semis and condos).

How the numbers were calculated

If you’ve provided with a pre-approval before, it’s likely a mortgage professional has already put your finances to the test using the GDS Ratio. Short for Gross Debt Service Ratio, this estimate adds up all your expenses (mortgage pays, utilities and taxes) and divides that number by your entire household income.

If your GDS works out to be 32 per cent of the members (or anything below) a property officially falls in your price range.

We did a reversal calculation and applied the 32 per cent regulation to average home prices in the first seven months of 2017 in order to identify the income you need to buy an average home.

The study factored in a down payment of 20 per cent, which is more reflective of moving up or moving down purchasers who’ve already built up equity from a previous property and first-timers who likely got some financial support from their parents. A five-year attached mortgage rate of 2.99 per cent of the members was used.

Note: In today’s marketplace, GDS ratio of up to 39% has been utilized by lenders to determine mortgages.

Remember, the buying journey is different for everyone

It’s important to note, this study is meant to provide a broad look into the market and factored in average sold prices. There are still plenty of properties out in the Toronto market that sell for below the market median.

Simply put, there are generally options out there for a variety of home buyers and incomes. Just be prepared to construct some compromises if you expect to keep to your budget.

That means based on your family income and budget, you may need to be flexible to your desired neighborhoods, type of housing, living area, renting basement apartment (if legally possible), monthly condo maintenance fees (if applicable) etc.

If you are planning to sell your home or Condo Apartment in downtown Toronto or in Central Toronto areas, please call, text of email Max Seal, Broker at 647-294-1177. Please visit http://www.TorontoHomesMax.com for a FREE Home Evaluation“.

If you are planning to buy a home or a Condo Apartment in the Central Toronto areas, please call, text of email Max Seal, Broker at 647-294-1177. Please visit my website http://www.centraltorontorealestate.com/ to find out available homes and Condos for sale in Downtown Toronto and Central Toronto areas.

Source: MoneySense

Ready to sell your house in Central Toronto? For a FREE Market Evaluation Online, visit http://www.TorontoHomesMax.com. Please call or text Max Seal, Broker at 647-294-1177 for more information.

If you are thinking to buy a house or Condo in Central Toronto areas and/or in Downtown Toronto areas, please call or text Max Seal, Broker at 647-294-1177 to buy your dream home or Condo. I offer you a 30-min “FREE buyer’s consultation” with NO obligation.