Central Toronto Real Estate TRREB Released January, 2020 Resale Market Figures

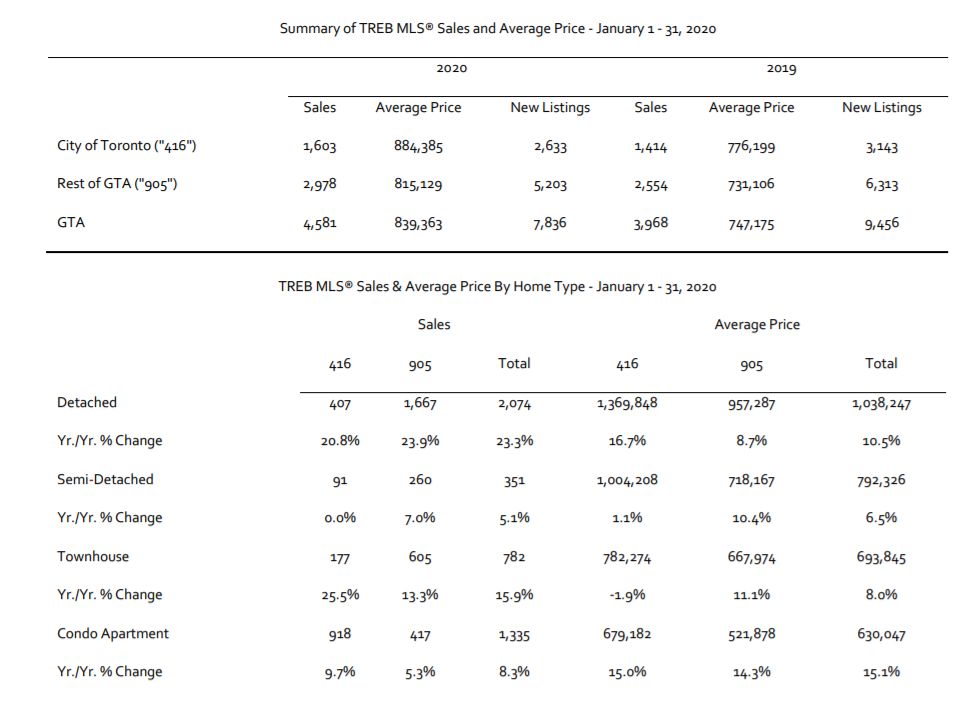

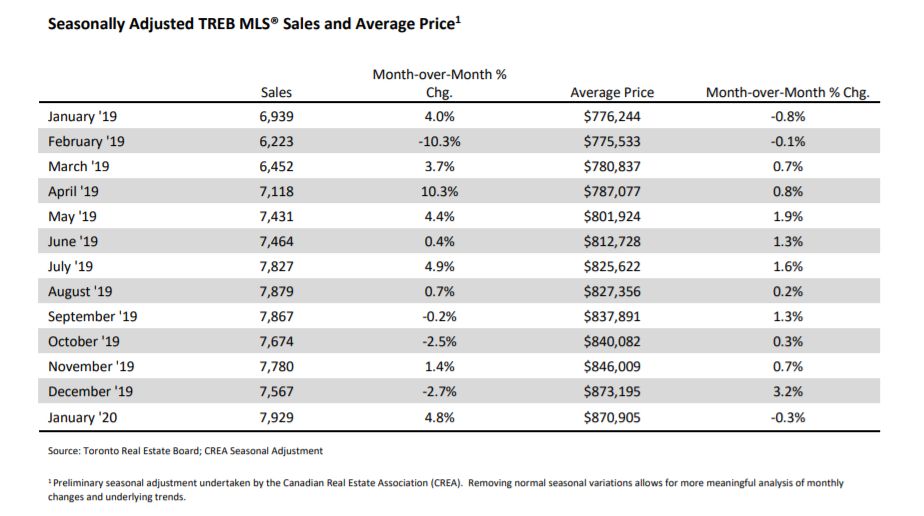

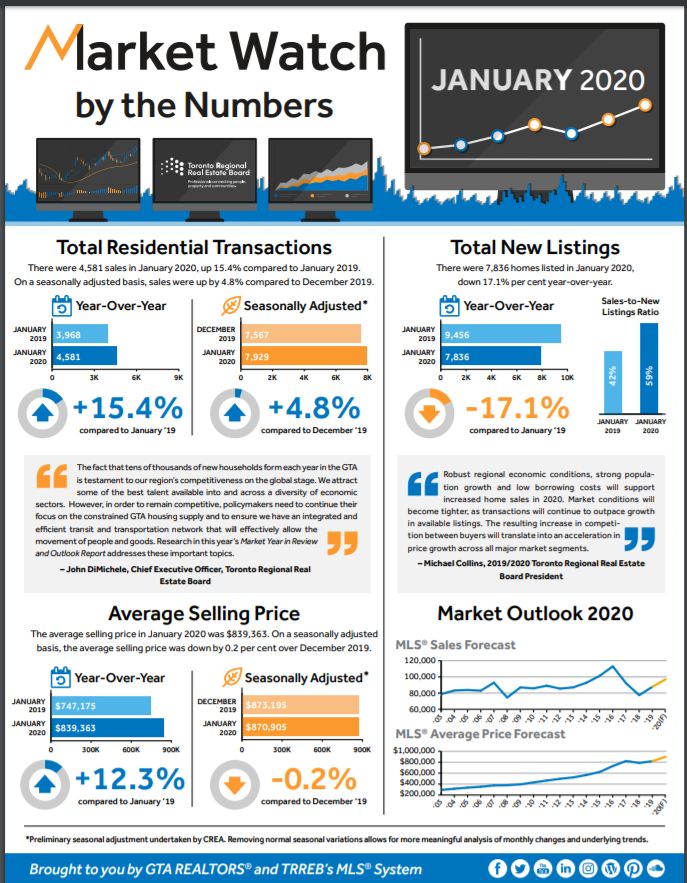

Toronto Area REALTORS® reported 4,581 home sales through TRREB’s

MLS® System in January 2020 – up by 15.4 per cent compared to January

2019. On a preliminary seasonally adjusted basis, sales were up by 4.8 per

cent compared to December 2019.

The Toronto real estate market showed very strong growth in the

number of sales up against a continued dip in the number of new

and available listings in January, 2020. Tighter market conditions

compared to a year ago in 2019 resulted in much stronger growth

in average selling prices.

Steady population growth, low unemployment and low borrowing

costs continued to underpin substantial competition between

buyers in all major market segments.

The MLS® HPI Composite Benchmark price was up by 8.7 per cent

compared to January 2019 – the highest annual rate of growth for the

Benchmark since October 2017. The condominium apartment market

segment continued to lead the way in terms of MLS HPI® price growth,

but all home types experienced price growth above seven (7) per cent

when considering the TRREB market area as a whole. The average

selling price in January, 2020 was up by 12.3 per cent, driven

by the detached and condominium apartment segments in the

City of Toronto.

A key difference in the price growth story in January 2020

compared to January 2019 was in the low-rise market segments,

particularly with regard to detached houses. It is clear that many

buyers who were on the sidelines due to the OSFI stress test are

moving back into the market, driving very strong year-over-year

sales growth in the detached segment. Strong sales up against a

constrained supply continues to result in an accelerating rate of

price growth.

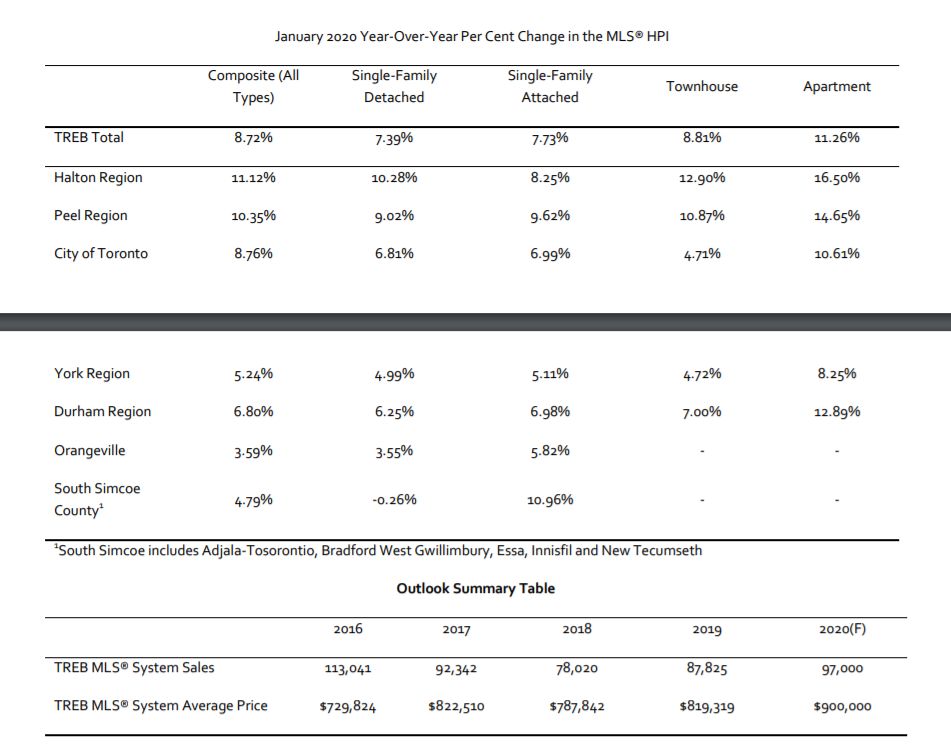

TRREB 2020 Outlook Summary

The following points summarize TRREB’s outlook for 2020 and results of the

Ipsos Home Owners and Home Buyers surveys:

Strong underlying demand drivers should see home sales crest the

90,000 mark in 2020, with a point forecast of 97,000 – up by almost

10.5 per cent compared to 87,825 sales reported in 2019. Sales growth

will be driven by the higher density low-rise market segments

(semi-detached houses and town houses) and the condominium

apartment segment. These home types are more affordable, on average,

and will remain popular with the OSFI mortgage stress test existing for the

future.

More than half of intending home buyers claimed to have been affected by

the OSFI mortgage stress test. In order to adjust to the more stringent

qualification standards, intending buyers followed a number of different

paths. The most common responses involved changing home price, type

or location. Some intending buyers also looked to alternate lenders, such

as credit unions or the secondary lending market.

The most popular home type for intending buyers was the detached house.

However, the share of intending buyers GTA-wide who sought a detached

house has declined markedly since the first survey in 2015 – from 54 per

cent in the fall of 2015 to 42 per cent in the fall of 2019. This decline was

evident both in the City of Toronto and surrounding regions. An increase

in buying intentions for condominium apartments and semi-detached

homes has accounted for the dip in detached buying intentions.

Unless we see a significant increase in supply, it is highly likely

that new listings will not keep up with sales growth in 2020. The

end result will be an acceleration in price growth over 2019, as

an increasing number of home buyers compete for a pool of

listings that could be the same size or smaller than in 2019.

The point forecast for the overall average selling price in 2020 is

$900,000, close to a 10 per cent increase compared to the average of

$819,319 reported for 2019. This forecast rate of growth presupposes

that price growth will continue to be driven by the less expensive

mid-density low-rise home types and condominium apartments. If the

pace of detached home price growth starts to catch up to that of other

major home types, the average selling price for all home types combined

could push well past the $900,000 mark over the next year.

While we did see an improvement in condominium apartment rental

supply in 2019, recent consumer polling coupled with the potential for

smaller returns on investment from rental income suggests that there are

still forces working against more balanced market conditions in the GTA

rental market. Policymakers at all levels of government need to be mindful

of rental supply requirements as the GTA population continues to grow on

the back of a strong regional economy and strong immigration. Expect

above-inflation annual growth rates in average one bedroom and

two-bedroom condominium apartment rents to be sustained in 2020.

“After more than three years of slower market activity brought on largely

by changes in housing-related policies at the provincial and federal levels,

home sales will move closer to demographic potential in 2020. The key

issue, however, will be the persistent shortage of listings. Without relief

on the housing supply front, the pace of price growth will continue to

ramp up. Policy makers need to understand that demand side initiatives

on their own will only have a temporary impact on the market,” said

Jason Mercer, TRREB’s Chief Market Analyst and Director of

Service Channels.

The Toronto Regional Real Estate Board is urging caution on the issue of

a possible vacant home tax in the City of Toronto. A measured approach to

the issue can help to avoid any unintended consequences on the housing

market and property owners. TRREB is concerned there is not enough

empirical city data or evidence to support this approach.

It is also important to point out that, just three years ago, City Council

increased the Municipal Land Transfer Tax (MLTT) on all home buyers

by an additional 0.5 percentage point and added an additional upper tier

rate of 0.5% on homes priced over $2 million to match the provincial LTT.

Continuous increases to the MLTT is an unsustainable and risky fiscal

strategy for the City.

While the current suggested MLTT increase by some councillors is focused

on higher-priced properties, TRREB is also warning about the potential

impact of this proposal on lower-priced properties. The real estate market

functions as a continuum. Policies that impact certain price points can

have a trickle-down effect by influencing move-up decisions of home-buyers,

thereby preventing the supply of lower-priced properties from being

freed-up for other home buyers. Anecdotal and statistical evidence suggests

that the MLTT has a direct impact on mobility.

Source: Toronto Regional Real Estate Board

======================================================

Thinking to sell your house or Condo in Central Toronto areas and/or in downtown Toronto areas? Please visit http://www.TorontoHomesMax.com for a FREE Home Evaluation“ or please call, text or email Max Seal, Broker at 647-294-1177. NO obligation.

Thinking to buy a House or Condo in Central Toronto areas and/or in Downtown Toronto areas? please call or text Max Seal, Broker at 647-294-1177 to buy your dream home or Condo. I offer you a 30-min “FREE buyer’s consultation” with NO obligation.

Please visit my website http://www.centraltorontorealestate.com/ to find out available homes and Condos for sale in Central Toronto areas and/or in downtown Toronto areas.

This Toronto housing market may be a better time for “Move-up”, “Move-down” or “Empty-nester” Sellers and Buyers. Want a “Market Update” of your home in 2019? Please click the image below or call or text Max Seal, Broker at 647-294-1177 or send an email.