Toronto housing slowdown reasons Bank of Canada showed

The Bank of Canada found the prices of the housing market went up way out of affordability range for buyers. The Bank estimated. that between 2015 and 2018, the rising cost of home ownership would have lowered annual home sales nationwide by a hefty 56,000 if the “housing bubble” effect was not present in the market.

The Bank estimated that Only a fraction of that — 10,000 sales — would have been due to the mortgage stress test, All the rest would have been due to rising prices and hikes to mortgage rates.

The Bank found that the affordability crisis happened about the same time as a jobs boom occured. It pushed up incomes and increased demand for housing by almost enough to offset the jump in home ownership costs.

With the jobs boom almost disappeared and the Canadian economy is close to a recession level, a housing slowdown is in effect, but no bust.

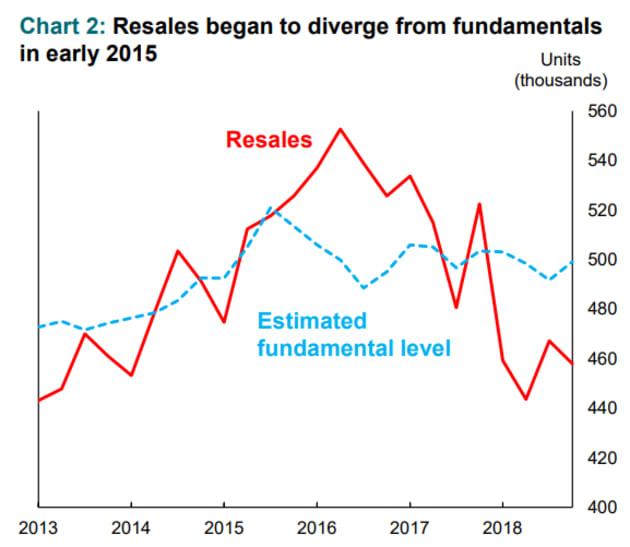

The Bank described the housing bubble quite succinctly. As per the Bank around 2015 and 2016, Toronto and Vancouver saw a spike in home sales, well beyond what you would expect at that level of employment and income. The increase in sales in that time was 10 times as large as it should have been, given economic conditions, the Bank estimated.

“Much of the previous strength in resale activity was influenced by extrapolative expectations. … These expectations quickly faded following the policy measures,” the report stated.

In other words, people panicked. Expecting house prices to keep growing rapidly, they jumped into the market as soon as they could, and so further pushed up prices and home sales.

Much as we’d like to blame foreign buyers or government policy, it seems we kind of did this to ourselves.

Max’s Humble Comments:

1) Well, in the Toronto housing market, the prices of single detached houses increased close to 100% (doubled) in five (5) years, between 2012 and 2017. It was a well-known fact since 2015 that the Toronto housing market was going through some kind of “housing bubble”. The increase of annual house prices was several times higher than the increase of the annual incomes.

2) All the level of Governments (Canada, Ontario and City of Toronto), were too busy to collect their taxes quite happily as the housing prices kept increasing rapidly till April, 2017. That was when the Ontario Government brought in the “Foreign Buyer Tax” rules.

3) The Bank of Canada side-stepped the legitimate issues of the earlier the Government inactions neatly.

When the new taxes and mortgage rules (OSFI rules) took hold, expectations went from too optimistic to somewhat pessimistic. Sales fell below because the buyers do not want to pay the higher housing prices.

The housing prices of Vancouver continue to decrease for several months. The Toronto housing market may follow similar route of lower housing prices. The market correction of the Toronto housing market may continue for several months.

And a rapid rebound seems unlikely. The Bank’s report suggests sales will likely remain sluggish until prices align better with incomes.

But so far, affordability isn’t improving, or at least not much. Prices remain elevated even as sales remain weak,

As Per the Bank of Canada analysis, “The housing market is currently in uncharted territory.”

With household debt rising to yet another record high at the end of 2018, Bank deputy governor Carolyn Wilkins expects consumers to keep hitting the brakes on spending.

“When consumers are highly indebted — and yes, it’s a major vulnerability, it’s the number one financial vulnerability for the Canadian economy — at some point households may start to say, ‘I need to increase my savings’,” Wilkins told reporters at a press conference on Wednesday.

At present, there are new taxes and new mortgage rules (OSFI rules), And there are high debt levels, not so booming job market and Canada may face an economic recession. How all these factors will affect the Toronto housing market going forward is difficult to predict.

Source: HuffPost

Thinking to sell your house or Condo in Central Toronto areas and/or in downtown Toronto areas? Please call, text or email Max Seal, Broker at 647-294-1177. Please visit http://www.TorontoHomesMax.com for a FREE Home Evaluation“.

Thinking to buy a House or Condo in Central Toronto areas and/or in Downtown Toronto areas? please call or text Max Seal, Broker at 647-294-1177 to buy your dream home or Condo. I offer you a 30-min “FREE buyer’s consultation” with NO obligation.

Please visit my website http://www.centraltorontorealestate.com/ to find out available homes and Condos for sale in Central Toronto areas and/or in downtown Toronto areas.

This Toronto housing market may be a better time for “Move-up”, “Move-down” or “Empty-nester” Sellers and Buyers. Want a “Market Update” of your home in 2019? Please click the image below or call or text Max Seal, Broker at 647-294-1177 or send an email.