To rent or buy? That is a question Canadians across the country face as they weigh the pros and cons of making the leap into home ownership.

Conventional wisdom says to buy property. We’re not making any more land, and with the Bank of Canada keeping interest rates low and mortgage rates falling it might seem like a good time to purchase that first property.

Canadians should also consider that housing markets are regional. Outside of the red-hot real estate markets of Vancouver and Toronto, average home prices across Canada were actually down 0.3 per cent in January, to $286,911, according to theCanadian Real Estate Association.

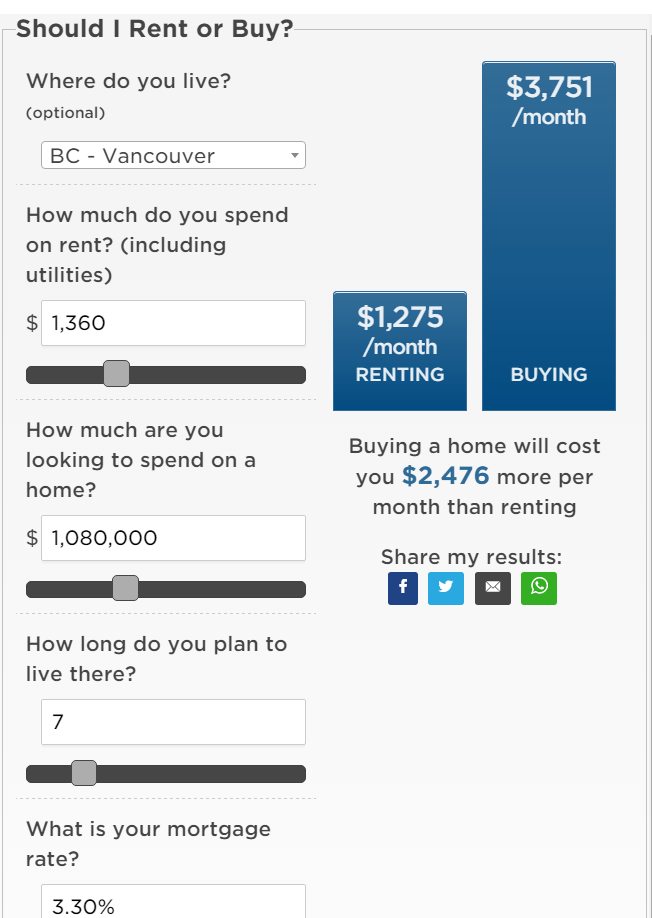

Should I rent or buy? Try Global’s real-estate calculator to help you decide.

2. How much do you have saved for the down payment?

Under the new changes that came into effect on Feb. 15, 2016, homebuyers will be required to put a 10 per cent down payment on mortgages over $500,000. The five per cent rule remains the same for the portion up to $500,000.

READ MORE: $2.4M ‘knockdown’ sums up Vancouver housing market

But Milevsky strongly recommends homebuyers go beyond the five or 10 per cent

“I really think it’s important to have that 15 to 20 per cent down payment,” he said. “It’s a cushion in the event something goes wrong. It’s a cushion in the event you need to borrow against the house for liquidity reasons.”

“The last thing I want to hear is someone say to me ‘I got a bank that will lend me 95 per cent of the value of the house and all I need to put down is five per cent.” He added. “It’s not smart.”

3.What about the “hidden costs” of home ownership?

If the roof needs to be fixed or the furnace breaks down you’ll be on the hook for the costs of maintaining a house.

“Things break down,” said Milevsky. “You can’t call the landlord and say ‘hey buddy, fix it.’ That’s one of the lovely things about renting, if something isn’t working, call the landlord.”

READ MORE: The Toronto condo bust that wasn’t

First-time buyers looking at a condo should also be aware of monthly fees. In 2015, an average 1,000 sq. ft. condo in Toronto came with $590 in monthly maintenance fees, up from $440 in 2005, according to research from Condos.ca.

“It’s not just annoying, it’s like a second mortgage,” said Milevsky. “If your condo association votes for a special assessment your fees can also go up.”

While maintenance fees start off lower in new buildings, they rise quickly in older buildings.

4. Do you have money saved for closing costs?

While first-time buyers don’t have to pay certain fees there are a number of other closing costs that need to be taken into account.

Land transfer taxes, lawyer fees, real estate agent costs and appraisal and home inspection fees all need to factored in says Milevsky.

“People should know a little bit more about what the cost of buying and selling a property is,” he said.

(Real-estate calculator methodology)

To calculate your monthly rent, we assume your rent will increase with inflation (2 per cent per year) and that you purchase renter’s insurance (at 1.32 per cent your monthly rent).

To calculate the monthly costs of owning a home, we determine your monthly mortgage payment at the interest rate you specify, assuming you will pay the mortgage off fully in 25 years. We then add costs for property tax (1.2 per cent the value of your home each year), homeowner’s insurance (0.46 per cent the value of your home each year), maintenance costs (1 per cent the value of your home each year) and utility costs ($300 a month). These costs are assumed to rise either with inflation (2 per cent per year) or the value of your home (4 per cent per year). If your down payment is below 20 per cent a mortgage insurance premium is added to your mortgage at CMHC proscribed rates. We also add a one-time fixed cost of your down payment, as well as the closing costs associated with buying and selling the home (at 4 per cent and 8 per cent the value of your home respectively). The net gain from selling your home is subtracted from the total costs.

We apply a net present value calculation to each of these values to get the cost in today’s dollars. Put simply, money earned today is worth more than money earned in the future because of its earning potential. This acts to decrease rental costs, as those are spread out over many years. Buying a house, on the other hand, involves large upfront costs, while the proceeds are put off years into the future, and are thus worth less in today’s dollar. This acts to increase home ownership costs relative to renting.

Read the full post in Global News