Pressure is growing on Ottawa to take action on housing prices as banking executives are joining economists and global think-tanks in sounding the alarm about the runaway markets in Toronto and Vancouver.

The latest call for action came from National Bank of Canada chief executive Louis Vachon, who told Bloomberg on Wednesday that Canada should eventually return to a 10 per cent minimum down payment for mortgages, from the current five. That follows comments from Scotiabank’s CEO, Brian Porter, that revealed the bank is scaling back its mortgage lending in Toronto and Vancouver because of concerns about housing prices.

New data Thursday from the Real Estate Board of Greater Vancouver showed prices in city spiked 29.7 per cent in May, compared to the same time last year.

The Department of Finance said in a statement to the Financial Post that it is watching what is going on in the housing market and “prepared to take further action if required,” but that there are no new measures planned for now.

In February, the federal government changed mortgage rules so that buyers must now pay a 10 per cent down payment on the portion of a home purchase above $500,000. The next month, the government announced in its budget that it was providing $500,000 to Statistics Canada to help it gather data on foreign housing investors.

But there is no consensus on how best to cool the market, as there are major regional differences in activity. While Vancouver and Toronto have seen record price gains in recent years, other markets, such as those in Atlantic Canada, Saskatchewan and Alberta, have seen declines.

Advertisement

The B.C. government last month introduced new rules in the province to try and cool some of the frenzy, specifically clamping down on shadow flipping — a practice where the same house is sold multiple times by the realtor after the initial sale by the owner. Also starting on June 10, non-Canadian homebuyers will be required to list their citizenship on property transfer tax forms, which will help better assess how much foreign buyers are driving up prices.

Bob Rennie, founder of Rennie Marketing and one of the most well-known figures in Vancouver’s housing industry, is against any type of tax that specifically targets foreign buyers.

Instead he suggests creating a speculation tax that would protect first-time buyers. “You either have to curb demand or increase supply, taxing foreign owners won’t do anything. It will cause racism in my province that is worse than it is now,” said Rennie. “If there was a cooling off period for people who bought new condos in pre-sales, that if you sold within a year resulted in a heavy tax, that would (deal) with people (messing) with first-time buyers.”

He added that even at today’s prices it’s “a myth” that the Vancouver region is one of the most expensive in the world for real estate. “The city of Vancouver is but the region isn’t. Nobody in Toronto is trying to get affordability into Forest Hill or Rosedale,” said Rennie, referring to two of the most priciest areas to buy housing in Canada’s largest city. “Here in Vancouver everybody wants to live in the city and we have to change that dialogue.”

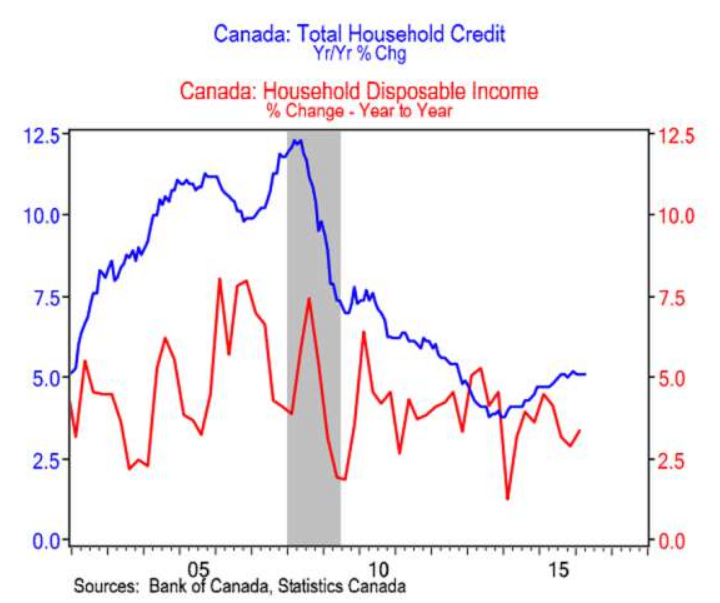

Benjamin Tal, deputy chief economist, CIBC World Markets, said that a number of different factors are behind the steady rise of prices in both cities. This includes limited space to build newly detached homes, low interest rates and foreign buyers, among others. Unfortunately, a lack of data makes it difficult to determine how much each factors into the bigger picture, making targeted actions more difficult.

“Low interest rates can hide a lot of bad things and you have to tread very carefully,” he said.

But Tal said some tightening of rules is needed, especially as it has become clear housing risks have increased.

“The subprime segment of the market is rising, because banks are regulated in a way where they cannot really provide credit to higher-risk clients the way they used to,” he said. “So they go to alternative issuers and that means the subprime segment of the market is rising faster than the regular market. And all of this is raising the entire risk profile of the market.”

Read the full post in Financial Post